|

The Hamilton 1731 – 1735 Ave of the Americas NY, NY Portfolio:May 2016The Hamilton, built in the late 1980’s is a luxury building located in the Upper East Side of Manhattan on York Avenue between 90th and 91st streets. The building consists of 279,945 square feet and contains 265 residential units plus 4 commercial units. The building features a grand two-story lobby and two landscaped terraces. G Malone & Co, was the sole broker on this transaction who helped negotiate the non-renewal of 32B union contract so that the purchaser would have a union free building upon closing. The property was sold by Glenwood Manager and to the Purchaser, Bonjour Capital LLC, for approximately 140 million dollars with a 3.5% cap rate. |

|

87 Building West Harlem Portfolio:

This multi-family portfolio consist of 87 pre-war buildings including 1,597 apartments and 41 stores. It is bounded by 160th Street to the North, 111th Street to the South, Lenox Avenue to the East and Riverside Drive to the West. The entire portfolio is comprised of 1,428,494 square feet with an additional 204,954 sf of unused FAR.G Malone & Co, the sole broker on these transactions, successfully structured these 2 off-market deals in November 2013. In 2006, the Seller sold to AIMCO a 10 year option to purchase these 87 buildings for 270MM, at 2006 prices. In return, AIMCO provided to seller a 10 year 2nd mortgage in the amount of 110MM.In August 2012, Seller hired Maloneco to buy back AIMCO’s Option and pay off the 2nd mortgage. After months of negotiations on behalf of Seller, Maloneco was able to structure a transaction with AIMCO in which the Seller refinanced both the 1st and 2nd mortgages, paid AIMCO 19MM to buy back Option then resold properties for 350MM approximately, 70MM more than the AIMCO price. |

|

The Rivergate, 401 E 34th St, New York, NY

G Malone & Co, represented UDR, Inc. as buyer for the off-market $443 million acquisition of the Rivergate, a multi-family rental building containing 706 residential units, offices and retail located in Murray Hill. The purchase price represents about a 3.8% capitalization rate. UDR plans to spend $40 to $60 million to rehabilitate the building, and raise rents by an average of about 65 percent (current average rent is about $41 psf versus market rent of $60 psf for unrenovated units or $68 psf for renovated units). The 35-story building contains 835,279 square feet, with underground parking for 80 cars, full-time doorman and concierge services, roof deck, outdoor park with playground and a rooftop fitness center with pool. Many of the units have balconies, and some of the units have large terraces and fireplaces. The North, South and Eastward facing units have views of the East River. This former 421a building (about 45 stabilized units remaining) was developed by Donald Zucker’s Manhattan Skyline Management Company in 1985, and sold from Zuckerto UDR in July, 2011. Denver-based UDR, Inc. is an S&P 400 company Real Estate Investment Trust (REIT) which owns and manages over 60,000 residential units throughout the United States. |

|

The Westbourne, West 137th St, New York, NY

G Malone & CO, represented Extell Development Corp in the $66.2 million off-market purchase of The Westbourne, a beautifully restored classic Pre‐War apartment house in the historic Hamilton Heights neighborhood in West Harlem, NY, consisting of 5 contiguous buildings occupying the entire north side of W 137th Street between Broadway and Riverside Drive. The property consists of 182 apartments and one retail unit. |

|

The Addison, 230 Livingston Street, Downtown Brooklyn, NY

G Malone & Co, represented the buyer of two notes on The Addison, a 271 residential unit luxury rental property in Downtown Brooklyn. The buyer, Chicago-basedWaterton Associates, owner and manager of residential properties throughout the United States, acquired these two notes totaling about $150 million at an undisclosed discount, which represents Waterton’s first transaction in New York City. The note purchases included the senior mortgage from iStar Financial and the mezzanine loan from Capital Mezz, an affiliate of Archstone Smith. The Addison is a 188,060 square foot property consisting of two 26-story contiguous apartment buildings connected by a common lobby, with two retail stores, underground parking for 110 cars, a health club and an event room. The developer, North End Equities, is completing the condo-style interiors of the building and will retain management of the property. |

|

West 135th Street, West Harlem, NY

G Malone & Co, represented AIMCO as the Seller of ten contiguous, six-story elevator affordable housing properties located on West 135th Street in West Harlem. Located one-block away from the subway stop on 135th and Lenox Avenue, the 162,960 square feet of buildings include 198 residential units and five commercial units. G Malone & Co, introduced the deal to Jonathan Rose Companies to purchase the buildings for approximately $26,700,000.00. The plan for this acquisition was for these buildings to be the first “green” environmentally friendly retrofits of existing buildings, which included the preservation of affordable housing. |

|

Chelsea Ridge, Dutchess County, NY

The Chelsea Ridge apartment complex includes 39 buildings with 834 rental garden apartments units and large retail component, for a total gross building area of 798,744 square feet, as well as 3 maintenance buildings, 3 tennis courts, 3 basketball areas and a swimming pool. G Malone & Co, represented AIMCO as the Seller and introduced the deal to the Solomon Organization, owner-operator of approximately 10,000 apartments, town homes, and residences spanning New York, New Jersey, and Pennsylvania. This property was originally sold to AIMCO by G Malone & Co, in 2002 for $41,500,000.00. In 2009, The Solomon Organization purchased the Chelsea Ridge apartment complex from AIMCO for approximately $75,000,000.00. |

|

Hudson Harbor, Poughkeepsie, NY

The Hudson Harbor apartment complex contains 352 rental garden apartments. G Malone & Co, represented AIMCO as the Seller and introduced the deal to the Solomon Organization, owner-operator of approximately 10,000 apartments, town homes, and residences. The Solomon Organization purchased the Hudson Harbor apartment complex for approximately $25,000,000.00. |

|

Morrisania Towers, Bronx, NY

Located several blocks away from Yankee Stadium and diagonally across the street from the Bronx Courthouse Complex, this 203 unit affordable housing property is on East 161st Street in the Bronx. The L-shaped 8-story elevator building is in close proximity to the subway and Metro North. The total square footage of the building is 239,712 SF. Taking into considering the allowable FAR on the property, the purchase also included 492,075 SF of unused air-rights. G Malone & Co, represented AIMCO as the Seller for approximately $15,000,000.00. |

|

156 William Street

G Malone & Co, represented Capstone Equities in its Off-Market purchase of 156 William Street. The +/-240,000sf office building located in the downtown Manhattan market offered significant upside due to below market rents, which averaged approximately $23/sf at the time of the sale. Market rents in the area for similar quality properties ranged from $36/sf to $42/sf. The discrepancy between average in-place rents and market rents, coupled with +90% turnover in the first five years, enables the buyers to capture the upside on the income. The downtown market has experienced significant rent growth, as the gap between the downtown and midtown markets which had widened in recent years began to shrink. G Malone & Co, negotiated on behalf of Capstone’s Josh Zamir and Daniel Ghadamian. The seller, AFIAA, a Swiss real estate investment firm had purchased the building over two years ago for $40.75 million. The $60 million purchase price for 156 William Street equated to about $250 per sq. ft., well below the market average for similar properties. The transaction was completed due to the efforts of all parties despite significant challenges in the financing arena. G Malone & Co, was the sole broker on this transaction. |

|

13 Building Upper East Side Portfolio:

The multi-family portfolio consists of 13 Buildings, 322 apartments and 7 commercial units. A majority of the portfolio (9 buildings) is located between 50th and 90th streets from York Avenue to 2nd Avenue. The remaining assets are scattered throughout the neighborhoods of Murray Hill, Union Square, and Greenwich Village. The properties range in size from 20 to 55 units, with an average building size of 25 units. The portfolio consists of six elevator buildings and seven walk-up buildings. At the time of closing, the portfolio was 69% rent-regulated with an average rent of $1170 ; thirty-one percent of the portfolio units were at market value with an average rent of approximately $1600. G Malone & Co, represented the Seller in the transaction which was worth at $85 MM or $260,000 per unit. |

|

Upper West Side Landmarked Movie Theatre:

This transaction entailed a 99-year lease for a two-story theatre of approximately 15,000 square feet on Broadway between 99th and 100th Streets. The Buyer, John Soto entered into a long-term lease with the Owner of the Property and plans to significantly upgrade the facility through a major renovation program. The “as-of-right” development for the parcel was significantly greater than the existing building, however, the Buyer could not raze and re-develop the site because of the building’s landmark status. Moreover the Owner had previously sold the air-rights to Extell Developments for its Ariel East project. The theatre is located at 2264-2266 Broadway, immediately adjacent to Extell Development’s Ariel East and Ariel West condominiums. This area is undergoing remarkable gentrification and development, consequently, the retail valuation of this frontage on Broadway was the motivation behind the deal. G Malone & Co, was the sole broker on the deal which was valued at $9 MM during the 3rd quarter of 2006. |

|

88 Building West Harlem Portfolio:

This multi-family portfolio consists of 88 pre-war buildings including 1,597 apartments and 41 stores. It is bounded by 160th Street to the North, 111th Street to the South, Lenox Avenue to the East and Riverside Drive to the West. The entire portfolio is comprised of 1,428,494 square feet with an additional 204,954 sf of unused FAR. G Malone & Co, the sole broker on the transaction, successfully structured this off-market deal in November 2006. The Seller/Mortgagee retained management of the Portfolio and has the ability to earn an additional $40 MM in “back-end” payments based on future portfolio valuation. The transaction was structured as a 2nd loan where the Seller/Mortgagee was the recipient at 100% of today’s value. The Buyer funded a $9MM Vacancy Improvement Loan intended to enable the Seller/Mortgagee to enhance the rent roll and achieve certain valuations that would facilitate the “back-end” payments. Concurrently with the execution of the loan documents, both parties agreed upon a purchase “Put-and-Call” option whereby the Seller/Mortgagee could “put” the properties to the Buyer at a pre-determined price upon certain rent thresholds being met; the Buyer, on the other hand, could purchase the properties at the same pre-determined price. The Buyer benefits from this transaction with a return at or above market levels via the interest payments on the loan. The Seller/Mortgagee benefits from the ability to take out all the cash he had in the transaction and capitalize on future value; the Seller/Mortgagee benefits from a tax standpoint as well. The total value of the transaction was $270 MM ($164,835/unit), where the Seller/Mortgagee could potentially achieve additional compensation of $40MM for a total of $310 MM ($189,255/unit) plus the $9MM from the Vacancy Improvement Loan. |

|

10 Building Upper West Side Portfolio:

This multi-family portfolio consists of 10 buildings, 104 apartments and 15 units of retail space totaling approximately 91,423 square feet with an additional 80,012 sf of unused FAR. The portfolio is chiefly comprised of contiguous pre-war buildings on Manhattan’s Upper West Side at Columbus Avenue between 67th & 68th Streets (2 properties), Amsterdam Avenue between 82nd & 83rd Streets (2 properties) and West 83rd Street between Amsterdam and Broadway (2 properties). The residential portion of the portfolio ranges in size from 6-16 units with an average unit size of 666 sf. Nearly 50% of the units were rent-regulated with an average rent-regulated rent of $842. The average market rent was $2170. G Malone & Co, was the sole broker on the transaction. The firm successfully handled the off-market deal of approximately $50 MM between the Seller, The Rudd Group, and the Purchaser, AIMCO. |

|

45 Building Portfolio (Manhattan, The Bronx and Brooklyn):

This multi-family portfolio consists of 45 buildings including 1,681 apartments and 23 stores located in Upper Manhattan, Brooklyn and the Bronx. G Malone & Co, the sole broker on the transaction, successfully structured the off-market deal in February 2007. This transaction was especially interesting being structured as a joint-venture between the Seller and three prominent opportunity funds (Barclay’s Bank, Westbrook Partners and Normandy Real Estate Holdings). The opportunity funds were attracted to the property type, but lacked the necessary operating platform to proceed. In light of this fact, GMC structured the transaction which allowed the Owner to sell the real estate to a new LLC while remaining a 10% equity partner; the Seller/Owner also maintained rights to management fees and promotes. The transaction was valued at over $162 MM or $86,000 per unit. Based on the joint-venture structure, the Seller/Owner could gain $8.2 MM as a return on the equity investment of approximately $3 MM and an additional $15 MM in promotes. The Seller and the Properties would benefit from cheaper financing costs, an infusion of capital and major capital expenditures. |

|

Adam Clayton Powell Multi-Family Portfolio:

This multi-family, 19 lot portfolio consists of 263 apartments and 31 commercial units most of which are located on Adam Clayton Powell Jr. Blvd. (7th Avenue). The remainder of the properties lies between 143rd and 149th streets on St. Nicholas Avenue. All buildings are pre-war totaling approximately 160,456 net square feet with an additional 3,829 sf of unused FAR. The properties range in size from 9 to 30 units with an average unit size of 707 sf. More than half of the 263 residential units are rent-regulated; the average overall rent was approximately $1,028 with market rents as high as $1800/month. The portfolio bolstered a significant retail presence on a major boulevard with nearly 29,000 net square feet of retail space. The average in-place retail rent was $32 per square foot where the market demands between $45-55/sf. G Malone and Co, successfully brokered the deal on behalf of AIMCO. Heritage Realty sold the Portfolio for $53.6 MM. |

|

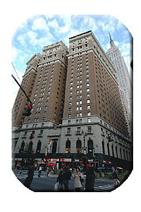

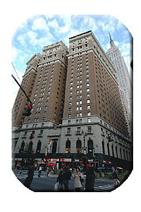

Herald Towers:

Herald Towers is a pre-war building formerly known as the McAlpin Hotel which was converted into 690 residential units, a 25,875 square foot health spa and a single retail unit. The property is situated on the same block as the Empire State Building at 50 West 34th street on the corner of Broadway and Sixth Avenue; it is separated into north, center and south towers. Approximately 127 of the residential units (18%) were rent-regulated with an average rent of $1500. The average market rent was $2250. The residential units range in size from 565 to 1191 square feet. Herald Towers is an extremely desirable property as it is located in one of the greatest shopping, sports and tourism hubs in New York City, Herald Square. Pennsylvania Station, Madison Square Gardens, the United States Postal Service Headquarters, the Empire State Building, Macy’s and a plethora of other popular establishments are within close proximity making the Herald Towers an extremely attractive property and a strategic addition to any real estate portfolio.The property originally went under contract in Dec of 2003 for approximately $150 MM; the contract holder was Property Markets Group (PMG). PMG entered into an agreement which allowed the company to defer closing until the Attorney General accepted the condominium conversion plan for the property. PMG repositioned the asset and took the building through the approval process. Upon reaching the 15% threshold (the number of units required to be under contract for the plan to be considered effective) PMG engaged G Malone & Co, to “flip” the contract. GMC successfully completed this transaction at $262 MM. Morris Bailey of JEMB entered into litigation with PMG under the accusation that PMG failed to adhere to their contractual obligations. While the respective companies where undergoing litigations, GMC was able to successfully negotiate with Morris Bailey to purchase the contract. Eventually Bailey and PMG settled as well. Bailey purchased the contract back from the Purchaser for $10 MM in addition to the $40 MM settlement with PMG. The value of the entire transaction, including the settlement was $310 MM. |

|

104 Building UWS/Harlem Portfolio:

The multi-family portfolio consists of 104 Buildings and 2,864 apartments bounded by 160th Street to the North, 100th Street to the South, 7th Avenue to the East and Riverside Drive to the West. Almost all of the buildings are pre-war and 45 contain ground-floor commercial/retail stores. The properties range in size from 8-552 units with an average building size of 24 units and average number of rooms per apartment of 4; the majority of the apartments are rent regulated (82% rent stabilized; 12% rent controlled). The portfolio contains 354,445 sf of unused FAR. Approximately one-third of the buildings in the portfolio have been identified by the buyers as candidates for future condominium conversion. G Malone & Co, was the sole broker on the transaction. The firm successfully handled the off-market deal by structuring a joint venture of two New York-based Opportunity Funds for $173,000 per unit. |

|

315 West 33rd Street

17 Penn Plaza

304-324 West 34th St. and 305-319 West 33rd Street

The Pennmark, which totals approximately 582,270 sf, is situated between 8th and 9th Avenues, midblock on 33rd and 34th streets. The property is 100% occupied and comprised of a 333 luxury apartment rental building, a 250 car garage, 13-screen Loews Theatre, 86,000 sfof retail space and is close in proximity to Penn Station, and Madison Square Garden. G Malone & Co, was the sole broker and represented the buyers, a partnership of OferYardeni and Joel Seiden, in this off-market transaction for 240 million in April of 2005. ThePennmark’s corporate tenants include Fleet Bank, Quiznos, Chipotle Restaurant, and Andrews Coffee Shop. Sharply setback from the sidewalk line, and all but invisible to the crowds at street level, the residential tower, with its distinctive window-wall facade, soars to a height of 35 stories, with unobstructed views of the New Jersey Palisades and the Statue of Liberty. |

|

240 West 73rd Street

The Tempo, a 16-story high-rise building with 200 apartments and ground-floor retail space located on New York City’s Upper West Side, purchased by Aimco for $51 million includes 139 studios, 48 one-bedroom, 11 two-bedroom and two three-bedroom apartments; a 3,000-square-foot space occupied by a Gymboree children’s store; and 2,500 quare feet of available commercial/retail space suitable for a restaurant or medical office. The address of the acquired property is 240 West 73rd Street, between Broadway and West End avenues. The building was built in 1928 and has been substantially renovated and features high-quality amenities such as a beautiful lobby, gym, atrium, laundry, storage and other services. The building is 100% occupied. With average monthly rents for the Upper West Side above $2,500 and the average rent for the 90 stabilized apartments at the Tempo at $453 a month, the property offers great upside value for Aimco. The remaining 110 apartments are being rented at market rates. The building also has a corporate leasing program, which serves Fortune 500 company employees. |

|

239 West 72nd Street

G Malone & CO, represented the estate of George Tzamouranis in the sale of this five-story pre-war walkup apartment building sold for more than $4 million. The 13,236-square-foot building is located on West 72nd Street between West End and Amsterdam Avenues. The property is 33 feet wide and features six 900-square-foot one-bedroom apartments, four retail stores and one commercial office. The rent-stabilized apartments in the building are large, substantially renovated, and feature high ceilings, fireplaces and hardwood floors. The retail stores have great upside as most of their leases are expiring in 2005 and 2006. |

|

514-516 East 88th Street

237-239 Ninth Avenue

322-324 East 61st Street

1582 First Avenue

G Malone & Co, represented AIMCO in the purchase of a portfolio of four properties, consisting of seven pre-war apartment buildings and six retail stores in Manhattan. AIMCO purchased the properties off-the-market for $27,650,000 from real estate owner Kamran Hakim. The four properties are located at: 1582 First Avenue (between 82nd and 83rd Streets), 322-324 East 61st Street (between First and Second Avenues), 237-239 Ninth Avenue (between 24th and 25th Streets), and 514-516 East 88 Street (between East End and York Avenues). All seven buildings in the portfolio were built between 1900 and 1920, and are almost 100% occupied. The First Avenue and Ninth Avenue properties are mixed-use, consisting of both residential units and retail spaces. Two-thirds of the 129 apartments are rent regulated, and the remaining 42 units are being rented at market rates, which offer great upside value for AIMCO. These are quality properties in highly desirable locations and are a fitting adjunct to Aimco’s portfolios on the Upper East and Upper West Sides. |

|

Embassy Suites Battery Park City

New York, NY

Located across the street from World Financial Center. It has views of the Statue of Liberty and New York City harbor. This hotel consists of 14 stories including 383,000 square feet constituting 463 suites all ranging from 450 square feet to 800 square feet. This mixed-use development includes a 16-screen cinema and approximately 60,000 square feet of retail and commercial space.Both deals, the 42nd Street Hilton Hotel and Embassy Suites Hotel at Battery Park City, are valued at approximately $380 million. |

|

42nd Street, Hilton Hotel

New York, NY

The Hilton Times square is a 25-story hotel with 304,000 square feet of space constituting 444 rooms and 6,000 square feet of other space. It is part of a hotel/retail and entertainment complex which also includes Madame Tussaud’s Wax Museum, a 25-screen AMC Cineplex, HMV Records and other dining and retail tenants. |

|

165-173 East 90th Street, New York, NY

This portfolio includes a total of five buildings, located on the prestigious Upper East Side. It is situated on East 90th Street between Third and Lexington Avenues and includes 74 units total. All five buildings were gut renovated in the mid-1980s and most of the units were not subject to rent stabilization. A portion of the units have back yards and fire places. The majority of the units consist of one and two-bedroom apartments. Ms. Malone represented AIMCO and in April, 2004, Milbrook Properties sold the portfolio off the market to AIMCO for $14,515,000. |

| |

1691-1693 2nd Avenue, 1695 2nd Avenue a.k.a. 236 East 88th Street and 238 East 88th Street, New York, NY

This portfolio also includes 510 East 88th Street and 452 East 78th Street. The purchase included a total of six buildings. Located on the Upper East Side, this property is almost always 100% occupied because of its prime location. Most of the units are totally renovated. The property is 75 units and includes 5 retail stores. It boasts a corner location and has quite a high FAR. Ms. Malone acted as the sole broker for this transaction. The property was sold off the market by the Manocherian Brothers to AIMCO in January, 2004 for $17,150,000. |

|

181-199 Columbus Avenue, New York, NY

Includes 72 West 69th Street, 74 West 69th Street, 76 West 69th Street, 75 West 68th Street, and 77 West 68th Street. Located on the Upper West Side, this 72-unit portfolio (including 12 retail stores) was another prominent property which was introduced by G Malone & Co, for AIMCO to purchase. The property consists of an entire block front on Columbus Avenue and has a footprint of 200′ by 100′. It is a major asset as the retail alone is worth $25,000,000. In August of 2003, the property was sold to AIMCO for $37,500,000. |

|

311-313 East 73rd Street, New York, NY

This 34-unit residential property is located on the Upper East Side and has a footprint of 50′ by 100′. G Malone & Co, represented AIMCO this time as a liaison between Buyer and Seller. Like all properties which G Malone & Co, brings to AIMCO for purchase, this prestigious property was not available on the market. In April of 2003, theManocherian Brothers sold the property to AIMCO for $5,000,000. |

|

9 West 20th Street

New York, NY

G Malone & Co, is a co-developer on this property. 9 West 20th Street, which sold for $7.5 million, is a 12-story commercial building converted into a 12-unit, plus penthouse, residential condominium with individual floor units of 2,400 square feet. There is also an existing 2,455 square foot retail unit located on the ground floor. |